BlackRock, the largest asset manager globally, has experienced its first outflow from its iShares Bitcoin Trust ETF in weeks. Following a period of two weeks with positive performance in the crypto market, the multinational investment firm has reported a cash outflow.

BlackRock Faces Setback in Strong Performance

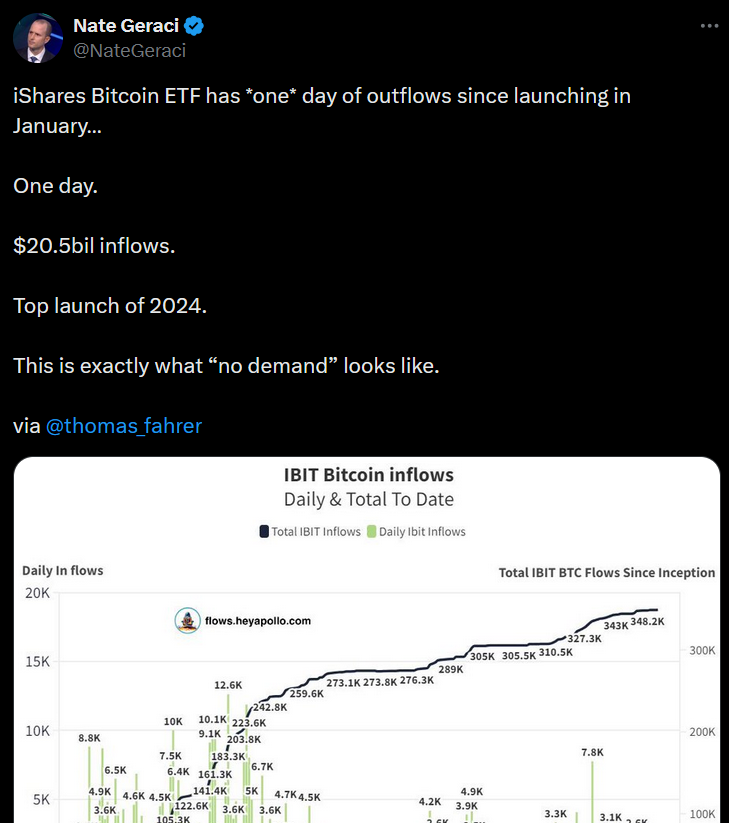

Data from Farside Investors reveals that on September 9, BlackRock (IBIT) saw a net outflow of $9.1 million. Apart from Grayscale (GBTC), which experienced a $22.8 million outflow, no other asset managers reported negative flows.

BlackRock had managed to avoid outflows since August 29, but this recent figure has broken its twelve-day streak. Nevertheless, the latest outflow of $9.1 million is over $4 million lower than its previous negative flow.

Despite the outflows from BlackRock and Grayscale, other funds such as Franklin, Valkyrie, VanEck, WisdomTree, and Grayscale Bitcoin Mini Trust did not record any flows. The positive performance of these funds resulted in a total inflow of $28.6 million.

Fidelity (FBTC) led with a notable $28.6 million inflow, followed by Bitwise (BITB) with $22 million. Additionally, ARK 21Shares (ARKB) and Invesco (BTCO) reported inflows of $6.8 million and $3.1 million, respectively.

Even with the recent outflow from IBIT, BlackRock remains the top asset manager in terms of flows. On average, BlackRock has achieved an inflow of $126 million, surpassing its nearest competitor, Fidelity, by over $69 million.

Fidelity’s average inflow stands at $56.9 million, and it has frequently outperformed BlackRock. The average inflow from other funds totals $39.7 million, except for Grayscale (GBTC), which has an average outflow of $120.7 million.

Despite the overall positive inflows from most asset managers, Bitcoin’s price in the crypto market continues to remain below $60,000. The leading digital asset has experienced significant volatility, briefly surpassing the $60,000 resistance level in the past month before falling back. As of the latest data from CoinMarketCap, Bitcoin is trading at $57,263.11, reflecting a 3.65% increase in the past 24 hours.