Since the launch of nine Ethereum ETFs on July 23, Ether liquidity on exchanges has plummeted by 20%. While Bitcoin’s spot ETFs have thrived this year, Ethereum’s market hasn’t mirrored this success.

According to data from CCData, the 5% market depth for ETH pairs on U.S. centralized exchanges has fallen to $14 million. Offshore exchanges have seen a similar decline, with liquidity dropping by 19% to around $10 million. This reduction in liquidity has heightened Ether’s sensitivity to large trades, with its spot price now more susceptible to swings of 5%. Analysts at CCData note:

Although market liquidity for ETH pairs on centralized exchanges remains higher than at the start of the year, it has decreased by nearly 45% since June’s peak.

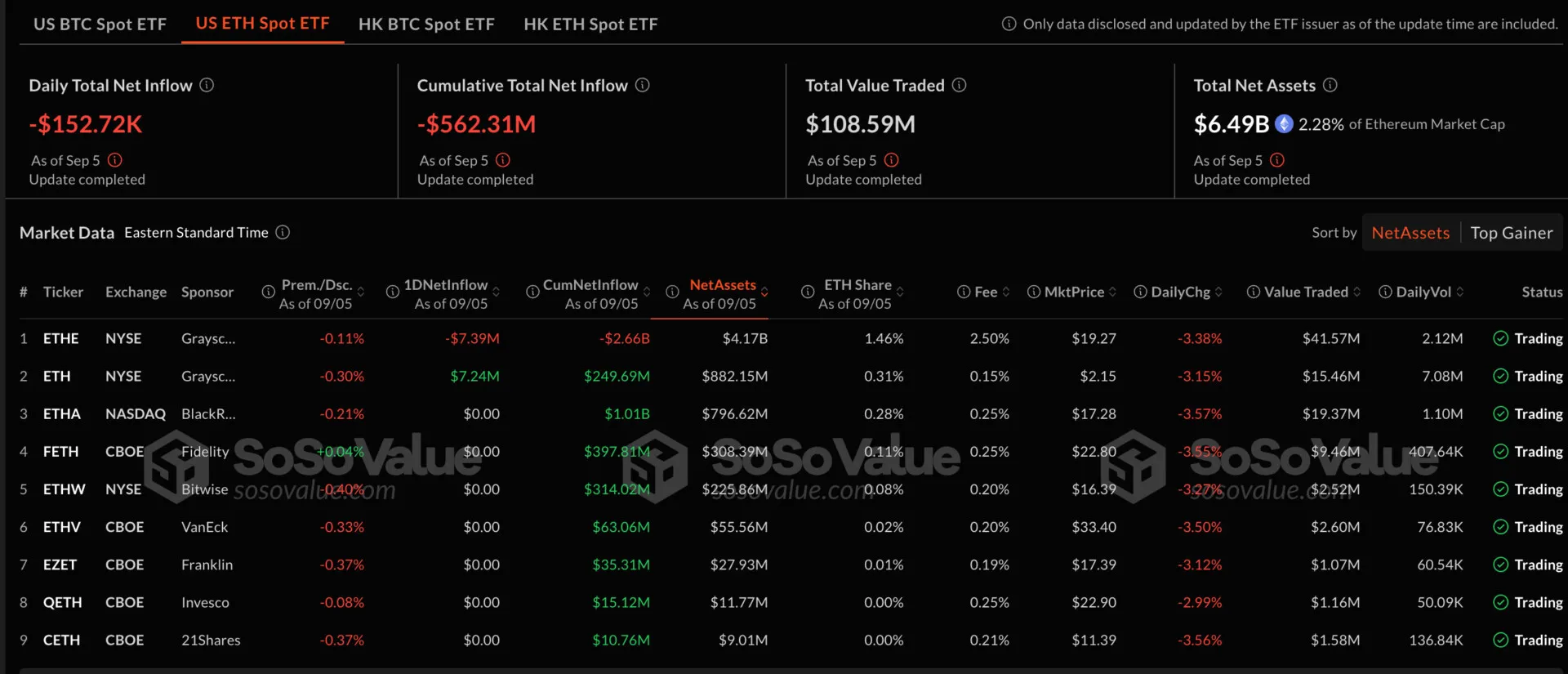

On September 5, Ethereum spot ETFs experienced a net outflow of $152,700. Grayscale’s Ethereum ETF (ETHE) faced a significant single-day outflow of $7.39 million, while Grayscale’s mini Ethereum ETF saw a modest inflow of $7.24 million on the same day.

The performance of Ethereum ETFs has been disappointing since their launch. Institutional investors have largely favored Bitcoin ETFs, which have attracted $5 billion in net inflows since their debut. In contrast, Ethereum ETFs have faced net outflows of approximately $500 million.

Additionally, Ether is grappling with controversies surrounding the Ethereum Foundation (EF), which manages around $650 million in reserves. Recently, Justin Drake disclosed in an AMA that the foundation’s annual expenditure is about $100 million, sparking rumors of insider trading and drawing Vitalik Buterin into the discussion. Buterin clarified that the plan is to spend roughly 15% of the remaining funds annually, ensuring the foundation’s sustainability but reducing its role over time.

The transition to proof-of-stake (PoS) has introduced further challenges. Changes in staking rewards have impacted Ether’s price, potentially contributing to the ongoing liquidity issues.

Moreover, the broader crypto market remains heavily influenced by Bitcoin’s price movements. Consequently, when BTC experiences fluctuations, Ether and other cryptocurrencies often follow suit.